- Startup Rabbithole

- Posts

- The Future of Finance is Here: 5 AI-Powered Early-Stage FinTech Startups Changing the Game in 2023

The Future of Finance is Here: 5 AI-Powered Early-Stage FinTech Startups Changing the Game in 2023

FinTech is on the precipice of disruption through advancements in AI and automation. As a product manager and startup builder, I am always on the lookout for early-stage startups and trends that are exciting.

I will evaluate these startups from a product perspective through the problems they solve and solutions they provide, as well as cover many other factors important to venture investors today. Here are five early-stage FinTech x AI products I am excited about in Q2 2023.

Subscribe to the Startup Rabbithole newsletter to exclusively learn about the most exciting early-stage startups: https://startuprabbithole.beehiiv.com/subscribe

Follow me on Twitter: https://twitter.com/EnterTheStartup

Want me to feature a startup or share it with investors/operators? https://forms.gle/TeXUfsaKd7FWNCYf7

1. TaxGPT: https://taxgpt.info/

Problem it solves: tax filings are an annual requirement for those in the United States. On average an “American taxpayer [spends] 11–13 hours to prepare their taxes according to the IRS” (Source). This can be split over multiple days or weeks.

Solution/Product: the product uses AI to automate tax filings quickly and securely.

Team: Kashif Ali, previous founder, Ex-Adobe. https://www.linkedin.com/in/chkashifali/

Traction: 1300+ users, interest from Mark Cuban, David Sacks, Jason Calacanis, and featured on My First Million.

TAM: $14.4bn in the US 2023 (Source).

Terms: likely bootstrapped at this point, with no funding disclosed yet.

2. Truewind: https://www.truewind.ai/

Problem it solves: SMBs and startups often have to spend thousands to hire finance teams to manage their bookkeeping and finances. Many founders lack time. Managing this requires both a time and effort investment.

Solution/Product: the product delivers reliable bookkeeping and financial models, automating finances with less errors than manual labor.

Team: Alex Lee — former founder, engineer, and investor. https://www.linkedin.com/in/alexlee611/,

Tennison Chan — ex Flexport, Pinterest, Alibaba. https://www.linkedin.com/in/tennisonchan/.Traction: they have several startup customers already — Sight Machine, Mio, Nimbus, Flagright, Mozart Data. Backed by Y Combinator, W23 batch.

TAM: $144.5bn in the US 2023 (Source).

Terms: YC backed so far.

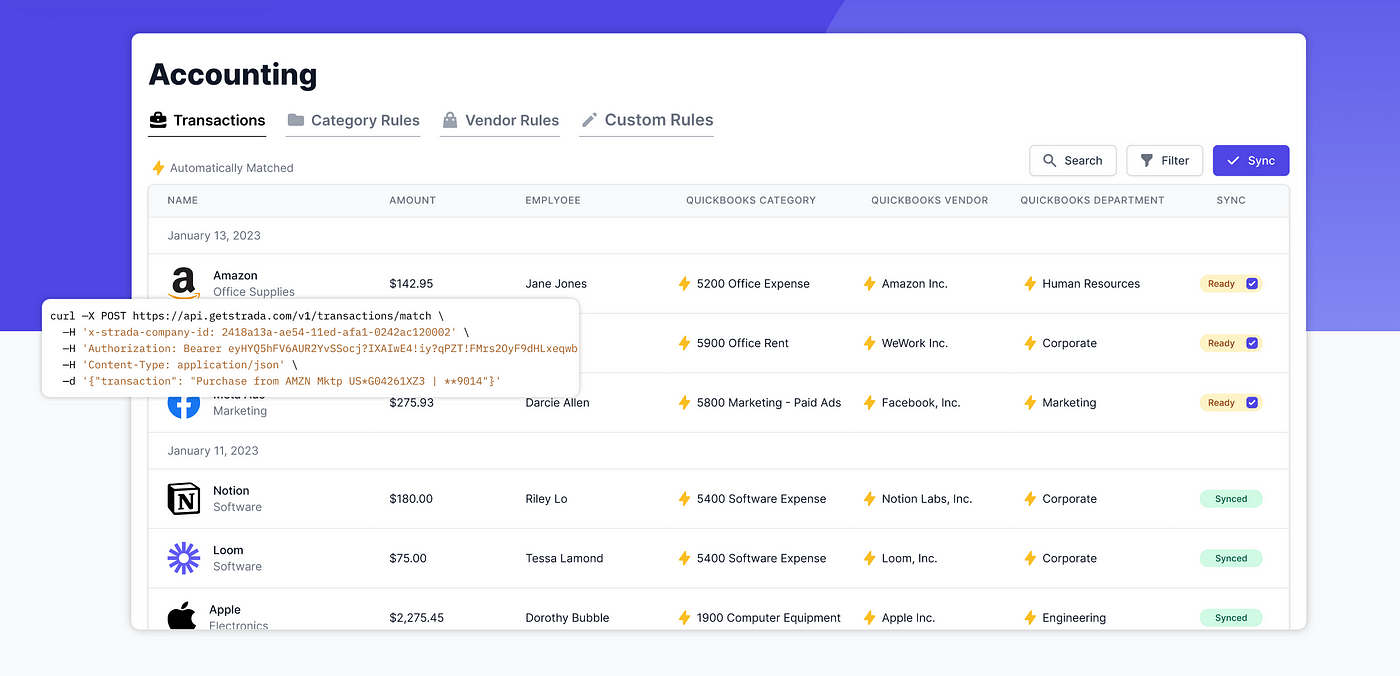

3. Strada: https://www.getstrada.com/

Problem it solves: accounting is an arduous process for SMBs and business owners. It can feel disjointed especially when you are working with multiple customers who are businesses or enterprises.

Solution/Product: the product offers a unified API with a few integrations to automate accounting classifications, create custom rules, and sync data in real-time. It helps companies grow their accounting expertise and efficiency by embedding accounting automation into their product. This can be especially helpful when working with several customers.

Team: Unknown, website states “brought to you by the team from Revolut, Microsoft, and KPMG.”

Traction: N/A

TAM: $144.5bn in the US 2023 (Source).

Terms: likely bootstrapped at this point, with no funding disclosed yet.

4. Deltx: https://www.deltx.io/

Problem it solves: as a business or consumer, it can be hard to track all of your expenses and know everything about your financials at all times. There are several sources of information. It is time intensive, requires focus, and often mandates hiring a team to manage these processes.

Solution/Product: the product uses AI to automate how businesses track their cashflow and expenses. They have several integrations, and the goal is to offer customers their own “AI CFO.”

Team: N/A

Traction: N/A

TAM: $39.05bn in the US 2029 (Source).

Terms: likely bootstrapped at this point, with no funding disclosed yet.

5. Docalysis: https://docalysis.com/

Problem it solves: reading documents can be a time intensive task for those working in finance. When you are going back and forth between meetings, constantly context switching, it can be difficult to find the focus and energy to read documents to find what you are looking for to perform an analysis.

Solution/Product: the product uses AI to search your documents and find answers, saving “95% of your time spent reading docs” (Source).

Team: Jeff Pickhardt, Former YC Founder, Stanford Physics graduate, Ex-Optimizely, Wealthfront, Hired, Google, Palo Alto Networks. https://www.linkedin.com/in/pickhardt/

Traction: https://www.producthunt.com/posts/ai-chat-with-10-k-reports-by-docalysis, https://www.producthunt.com/products/docalysis#docalysis

TAM: $20 trillion in 2020 (Source) — dependent on the use cases Docalysis chooses to focus on moving forward.

Terms: likely bootstrapped at this point, with no funding disclosed yet.

Subscribe to the Startup Rabbithole newsletter to exclusively learn about the most exciting early-stage startups: https://startuprabbithole.beehiiv.com/subscribe

Follow me on Twitter: https://twitter.com/EnterTheStartup

Want me to feature a startup or share it with investors/operators? https://forms.gle/TeXUfsaKd7FWNCYf7

Reply